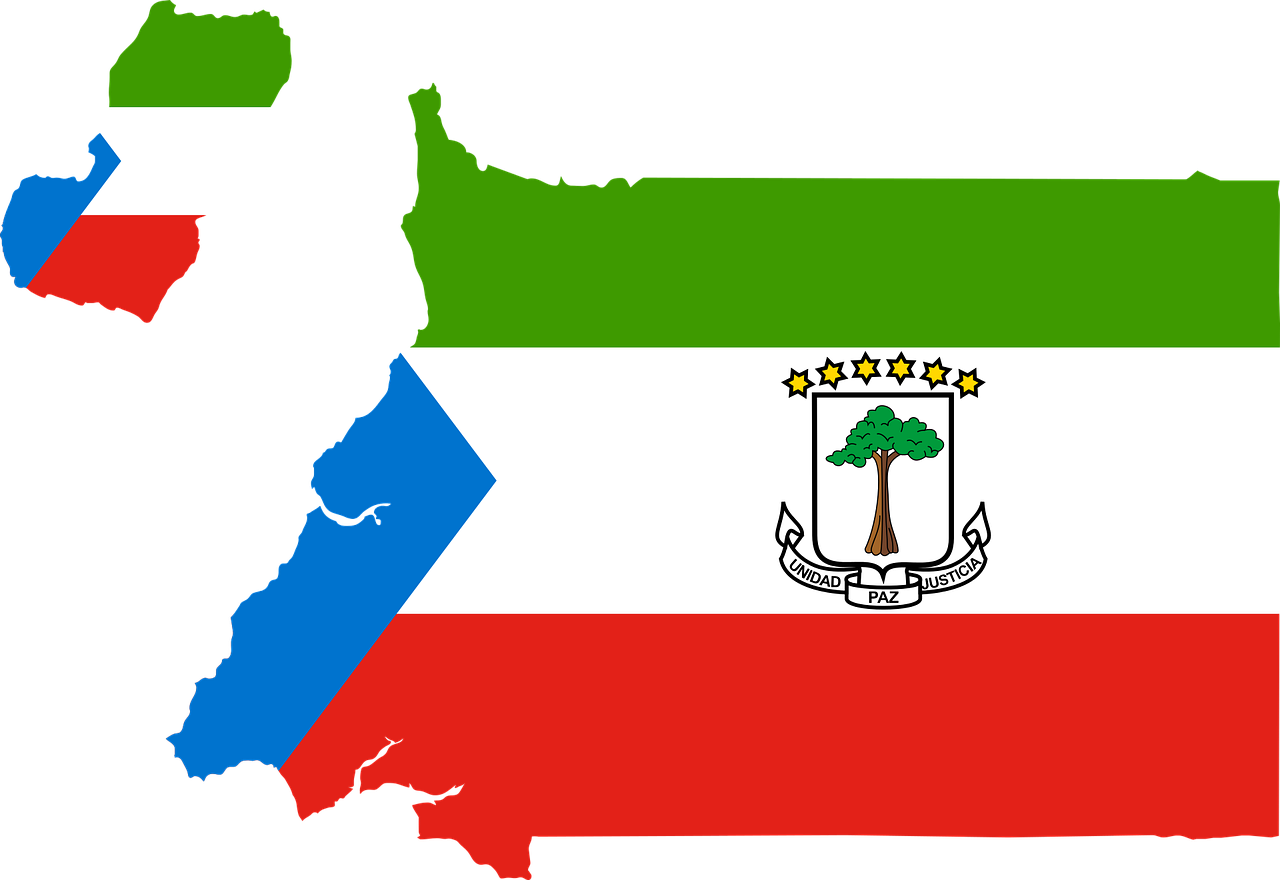

Company Incorporation in Equatorial Guinea

Expanding your business into Central Africa through company incorporation in Equatorial Guinea can open the door to a high-potential, resource-rich market.

Positioned strategically with access to regional and international trade routes, this jurisdiction is gaining traction among forward-thinking entrepreneurs.

With a favorable tax environment, multiple business structures to choose from, and incentives for foreign investors, Equatorial Guinea presents valuable opportunities.

However, the process involves several legal and administrative steps that must be handled with care.

In this guide, we’ll walk you through the key requirements, outline the steps to register a company, and explain the cost of company incorporation in Equatorial Guinea, helping you make informed decisions at every stage.

Fast facts about doing business in Equatorial Guinea

Equatorial Guinea is steadily becoming a hub for international business in Central Africa.

Its unique combination of natural resources, regulatory incentives, and regional integration makes it a competitive destination for investors seeking both stability and opportunity.

Businesses benefit from a relatively high GDP per capita, a fixed exchange rate tied to the euro, and a developing infrastructure network that includes ports, airports, and road systems designed to support trade and logistics.

Foreign ownership is permitted, and several industries offer sector-specific incentives, particularly in oil and gas, construction, tourism, and renewable energy.

Multinational companies operating here enjoy the advantages of a dollarized economy with favorable fiscal policies.

Key economic indicators

Equatorial Guinea’s GDP has shown signs of recovery, supported by oil exports and new government-led diversification plans.

Inflation remains controlled, and public spending continues to drive demand in areas like infrastructure, education, and healthcare, creating opportunities for private contractors and suppliers.

The country’s official currency, the Central African CFA franc, is pegged to the euro, offering exchange rate stabilityand predictability for international investors.

Tax and legal environment

The corporate income tax rate is generally set at 35%, which is standard across most sectors.

However, small and medium enterprises (SMEs) may qualify for reduced rates or temporary exemptions under specific development schemes.

Equatorial Guinea’s legal system is based on civil law and aligns with OHADA regulations, while gradually adapting toOECD tax policy trends to improve transparency and cross-border cooperation.

Businesses are also required to obtain sector-specific licenses and register with tax and social security authorities, but once these steps are completed, operations can begin relatively quickly.

Why Equatorial Guinea is a top destination for incorporation

Entrepreneurs choose Equatorial Guinea due to its strategic location, untapped markets, and political commitment to economic reforms.

The government actively promotes foreign direct investment, offering land concessions, tax holidays, and investment guarantees.

There’s also strong demand for infrastructure development, digital services, and import-substitution industries, creating a wide range of business opportunities for early movers.

The local workforce is young and growing, and while specialized skills can be scarce, many businesses bring in expatriate talent to train local teams and maintain quality standards.

Oil-rich economy with growing diversification efforts

Historically driven by oil and gas, the economy is now moving toward sector diversification.

Recent years have seen increased investment in agriculture, fisheries, and light manufacturing, backed by public and private capital.

This diversification reduces dependency on hydrocarbons and makes Equatorial Guinea more resilient to commodity price shocks, giving investors longer-term confidence in the market.

Government programs also support private-public partnerships, offering new ways for foreign businesses to collaborate on infrastructure and service projects.

Membership in OHADA and CEMAC for regional access

Equatorial Guinea’s membership in OHADA (Organisation for the Harmonization of Business Law in Africa) ensures a transparent, harmonized legal framework across 17 African countries, simplifying cross-border operations.

Through CEMAC (Economic and Monetary Community of Central Africa), businesses gain access to a broader regional market with shared monetary policy, customs cooperation, and free movement of capital.

These affiliations offer strategic advantages for companies planning to expand across Francophone Africa, making Equatorial Guinea an ideal launchpad for regional growth.

6 key advantages of incorporating in Equatorial Guinea

1. Strategic geographic location

Equatorial Guinea is located on the west coast of Central Africa, offering direct access to Atlantic trade routes. Its proximity to key regional markets positions it as a logistics and distribution hub for companies targeting both African and international clients.

The country also benefits from modern ports and airports, enabling efficient movement of goods and services throughout the region.

2. Access to regional markets through OHADA and CEMAC

As a member of OHADA and CEMAC, Equatorial Guinea provides businesses with access to a harmonized legal system and a common market of over 150 million people.

These affiliations offer simplified cross-border trade, free capital movement, and reduced regulatory friction, making it easier for companies to scale regionally.

3. Incentives for foreign investors

The government offers a range of investment incentives, including tax holidays, import duty exemptions, and repatriation guarantees. These measures are designed to attract long-term capital and encourage economic diversification.

Sectors like infrastructure, tourism, energy, and agribusiness often receive priority treatment under national development plans.

4. Business-friendly legal environment

Equatorial Guinea’s legal framework, aligned with OHADA, ensures clear corporate structures, predictable dispute resolution, and strong investor protections.

The process for private limited company registration is structured and standardized, providing clarity and legal certainty for foreign stakeholders.

5. Growing infrastructure and digital development

The country is investing heavily in transport, energy, and digital infrastructure, creating a more efficient operating environment for new companies.

Initiatives such as e-governance platforms and digital land registries are gradually improving transparency and reducing bureaucratic delays.

6. Opportunities across emerging sectors

While oil remains central, the government is actively promoting non-oil sectors such as fisheries, farming, construction, and renewable energy.

These areas offer first-mover advantages for businesses looking to enter underserved markets and participate in the country’s ongoing economic transformation.

6 common challenges for foreign founders

1. Navigating regulatory complexity

Despite recent improvements, local regulations can be difficult to interpret without in-country expertise.

Foreign founders often face delays due to unfamiliar legal procedures, multiple agency approvals, and evolving compliance requirements.

Understanding the administrative landscape early on is key to avoiding costly setbacks.

2. Language and communication barriers

While French and Spanish are official languages, most legal and business documents are in French, and English is not widely spoken.

This can create communication gaps during negotiations, documentation, and day-to-day operations.

Hiring bilingual legal and business advisors can help bridge this gap effectively.

3. Delays in company registration processes

Although the government promotes private investment, company registration in Equatorial Guinea can still take several weeks. Approvals from multiple authorities, plus the need for notarization and translations, often lead to delays.

Planning with a realistic timeline is essential to avoid disruptions in your launch schedule.

4. Limited local banking infrastructure

Opening and operating a corporate bank account may take longer than expected, with strict documentation checks and limited digital banking options. International transfers can also be slow, affecting cash flow.

Choosing the right financial institution and preparing documentation in advance are critical steps.

5. Finding and retaining qualified talent

While there is a growing labor force, skilled professionals in specialized sectors can be hard to find. Businesses often need to import talent or invest in local workforce training to meet their operational standards.

This requires upfront planning and may impact early-stage productivity.

6. Managing cultural differences in business practices

Business culture in Equatorial Guinea places strong value on personal relationships, formality, and face-to-face interactions.

Foreign founders unfamiliar with these norms may struggle to build trust or negotiate effectively.

Adapting to local customs and showing cultural awareness can significantly improve business outcomes.

Banking in Equatorial Guinea: What to expect

Opening a business bank account

Opening a business bank account in Equatorial Guinea is a mandatory step in the incorporation process.

Local banks typically request a complete set of company documents, including certificates of incorporation, tax registration, and identification for shareholders and directors.

Expect processing times of 1 to 4 weeks, depending on the bank and the completeness of your documentation. Some banks may also request a minimum deposit to activate the account.

Currency controls and regional banking compliance (BEAC)

Equatorial Guinea is part of the BEAC (Bank of Central African States) monetary union, which governs currency regulations for the region.

The currency, the Central African CFA franc (XAF), is pegged to the euro, providing exchange rate stability.

However, foreign currency transfers are regulated, and businesses must justify international payments through proper documentation.

It’s important to comply with BEAC’s capital control policies to avoid delays or penalties.

Taxation and compliance requirements

The country enforces several tax obligations for registered businesses. Companies must be aware of corporate income tax, value-added tax (VAT), and withholding taxes applicable to various transactions.

Timely filing of tax returns and accurate record-keeping are required to remain in good standing. Failing to comply may result in fines, interest charges, or operating restrictions.

Corporate income tax, VAT, and withholding tax

Corporate income tax is levied at a flat rate of 35% on net profits.

VAT is applied at 15% on goods and services, with exceptions for certain industries or transactions under specific thresholds.

Withholding taxes apply to payments such as dividends, royalties, and interest, generally ranging between 10% and 25%, depending on the nature of the payment and the recipient’s tax residency.

OHADA financial reporting standards and local requirements

Businesses must follow OHADA’s Uniform Act on Accounting and Financial Reporting, which ensures consistency across member states.

Financial statements must be prepared in accordance with SYSCOHADA standards and submitted annually.

Additionally, some sectors may require audited financials or sector-specific reporting, depending on licensing and regulatory oversight.

Residency, visas, and foreign ownership

Foreign ownership rules and licensing conditions

Equatorial Guinea allows 100% foreign ownership in many sectors, including services, construction, and certain manufacturing fields.

However, some regulated sectors, such as oil and telecoms, may require special licenses or joint ventures with local partners.

Obtaining the correct license is crucial for regulatory approval and access to industry-specific incentives.

Investor residency and sector-specific permit options

Foreign investors can apply for residency permits linked to their business activities. These permits allow long-term stay and re-entry, facilitating management and supervision of local operations.

Depending on your industry, additional sector-specific permits may be required, such as environmental clearance, health certifications, or technical licenses.

Early consultation with local authorities is advised to avoid bottlenecks.

Company registration timeline

Required authorities and legal procedures

Company registration in Equatorial Guinea involves several government bodies, including the Ministry of Justice, the Tax Authority, the Commercial Registry, and social security institutions.

Depending on the business activity, you may also need approvals from sector-specific regulators.

Legal procedures must follow OHADA standards, and most documents must be submitted in Spanish or French, with official notarization.

Estimated time for incorporation

The average time to complete new company registration in Equatorial Guinea ranges from 8 to 16 weeks, depending on the company structure and sector.

Timelines may vary if additional licenses are needed or if foreign shareholders require legal clearances.

Starting early and having all documentation ready is essential to avoid administrative delays.

Care About Us

Where Learning Begin

Building a strong sense of community in Greenville school

Community - Building Approaches

Our ekit SCHOOL courses

What do you want to learn today?

Your Complete Guide to Photography

Learn Python – Interactive Python

Introduction to Edu_Learn LMS Plugin

Your Complete Guide to Photography

Learn Python – Interactive Python

Introduction to Edu_Learn LMS Plugin

Restaurant

Bring Innovation to Your Company

Let’s start the journey towards success and enhance revenue for your business. Take your company to the next level.

Wealth Management

Right people together made to challenge established thinking and drive transform

Restructuring

Right people together made to challenge established thinking and drive transform

Step-by-step: how to incorporate a company in Equatorial Guinea

Most businesses register as a SARL (private limited company) or SA (public limited company) under OHADA regulations. The structure you choose will impact liability, reporting obligations, and capital requirements.

Draft the Articles of Association outlining the company's purpose, shareholders, share capital, and governance. These must be notarized by a local notary before any official submission.

Submit your desired company name to the Commercial Registry for reservation. If your business operates in a regulated sector, apply for the necessary business license at this stage.

Open a provisional bank account in Equatorial Guinea and deposit the minimum paid-up capital (typically USD 2,000for SARL). The bank will issue a capital deposit certificate, which is required for registration.

Submit the complete incorporation file, including notarized documents, capital deposit proof, and identity details of the founders. You'll receive a registration certificate and a tax ID number once approved.

If hiring employees, register your business with the Caja Nacional de Seguridad Social (CNSS) and the Labor Department to comply with employment and payroll obligations.

For businesses in regulated sectors such as energy, health, or telecommunications, additional government approvals or certifications must be obtained before operations can legally begin.

Equatoguinean business culture & practices

Formality, government relations, and local representation

Business culture in Equatorial Guinea is highly formal. Titles, respectful language, and in-person meetings are essential for building trust and moving negotiations forward.

Decision-making is often centralized, and forming strong relationships with government officials can significantly impact operational success.

Engaging local representatives or advisors who understand the institutional landscape is a practical way to navigate permits, approvals, and regulatory obligations with efficiency and credibility.

Multilingual context and importance of legal accuracy

Equatorial Guinea has three official languages: Spanish, French, and Portuguese, though Spanish dominates in legal and administrative settings.

This multilingual environment requires businesses to be meticulous with translations, contracts, and official filings to avoid delays or misinterpretations.

Working with experts who can ensure legal precision and language alignment is key to maintaining compliance and protecting your interests from the start.

How C2Z Advisory can help you succeed in Equatorial Guinea

Incorporation, legal, and OHADA compliance services

At C2Z Advisory, we provide end-to-end incorporation support, tailored to the specific legal and regulatory framework of Equatorial Guinea. From choosing the right company type to drafting OHADA-compliant documents, we handle each step with precision and strategic foresight.

Our legal team ensures your business meets all corporate governance standards, giving you a strong foundation for long-term growth.

Banking, licensing, and residency support

We assist clients with corporate bank account setup, business license applications, and investor residency processing, reducing complexity and ensuring full compliance with local and regional regulations.

Whether you’re managing currency controls, applying for sector-specific permits, or relocating executive staff, our team enables seamless global execution through our on-the-ground expertise and international reach.

Frequently

Asked Questions

Yes, foreigners can own 100% of a company in most sectors. There are no general restrictions on foreign shareholding for private limited companies, though strategic industries like oil, telecom, or defense may require special approvals or local partnerships.

Understanding the sector-specific legal framework is essential before structuring your ownership.

Yes, a local registered office is required, and in some cases, a resident legal representative must be appointed.

While foreign founders are not required to reside in Equatorial Guinea, local representation helps ensure compliancewith day-to-day regulatory requirements.

Many investors work with trusted service providers to manage their local presence efficiently.

The most widely used entity is the SARL (Société à Responsabilité Limitée), equivalent to a limited liability company (LLC).

It offers limited liability protection, flexibility in ownership, and lower capital requirements compared to public companies.

SARLs are governed by OHADA corporate law, providing a familiar legal environment for regional investors.

The average timeline for new company registration in Equatorial Guinea is between 8 and 16 weeks, depending on the business sector and completeness of documentation. Processes such as notarization, tax registration, and licensing can add to the timeline.

Proper planning and step-by-step execution are crucial for avoiding unnecessary delays.

Yes, companies operating in regulated sectors like oil, gas, energy, and infrastructure must obtain sector-specific licenses.

These permits often require additional documentation, technical qualifications, or environmental approvals.

Working with professionals familiar with licensing procedures and ministry protocols helps streamline approvals and reduce setup time.